Tax Bands Uk 2025/24. Higher rate band (over £50,270) the rest of john’s dividends fall into the higher rate band. The amount of gross income you can earn before you are liable to paying income tax.

The Steps to Going Self Employed Explained goselfemployed.co, The basic rate (20%), the higher. Perfect as a quick reference guide.

What are the Tax Bands in UK 2025/22 UK Tax Bands Explained, Higher rate band (over £50,270) the rest of john’s dividends fall into the higher rate band. Uk income tax rates and bands (excluding scotland) this table shows the bands and tax rates for 2025/25, compared to the 2025/24 tax year.

Understanding UK Tax Bands MoneySwot Guide MoneySwot™, Perfect as a quick reference guide. 0% tax on earnings up to £12,570;

Anyone else think that council tax bands are a little outdated? london, Dividends in higher rate band: Tax brackets for the 2025/24 tax year are updated below, following the budget on 15 march 2025.

Council tax bands Which?, Basic rate band (brb) £37,700: Legislation will be introduced in the autumn finance bill 2025 to set the pa for 2026 to 2027 at £12,570, and the basic rate limit for 2026 to 2027 at £37,700.

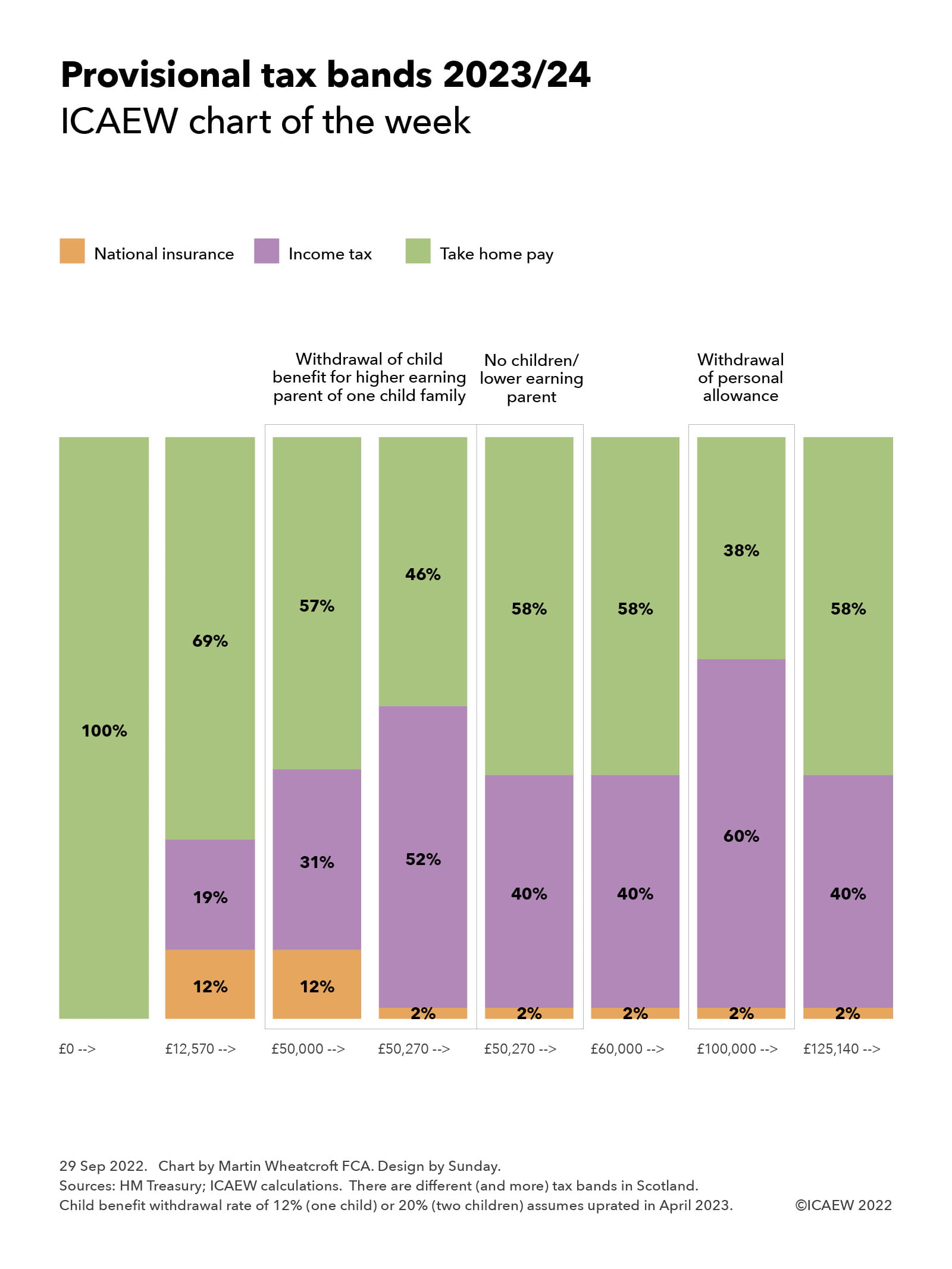

Chart of the week Provisional tax bands 2025/24 ICAEW, Tax brackets for 2025/24 tax year. Higher rate band (over £50,270) the rest of john’s dividends fall into the higher rate band.

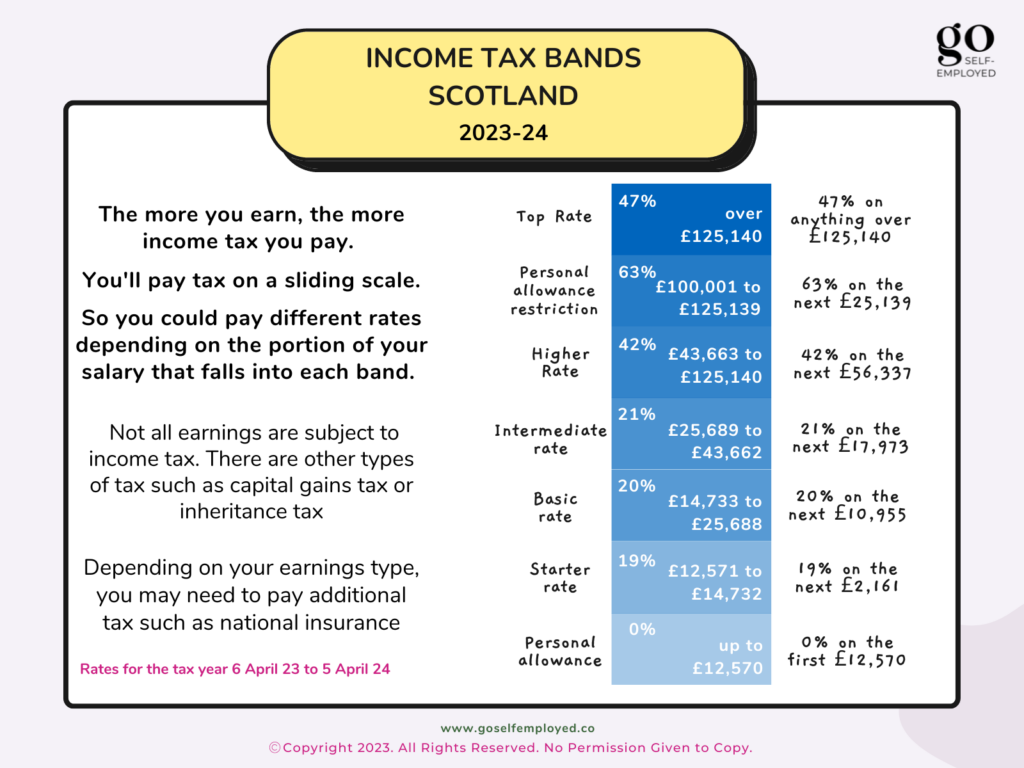

Tax Bands Scotland 202324, Any changes to the 2025/25 uk tax bands or rates will be officially announced in the government’s spring budget. £29,174 at 8.75% = £2,552.22.

The 40 Tax Bracket (+ 3 Ways to Avoid It) goselfemployed.co, Income tax bands and rates. Tax on dividends in basic rate band:

HM Revenue and Customs News UK Tax Rates and Bands 2017/18 Cheney, They are capped at 21% for the tax years 2026 to 2027 and 2027 to 2028. What are the 2025/25 income tax bands and rates?

UK Tax Bands & Calculating Tax On Via Spreadsheet (FY20/21), £11,826 at 33.75% = £3,993.77. This interactive chart lets you see the current ruk and scottish marginal tax rates for 2025/24 and 2025/25, with/without child benefit and student loans.

Rates for bands 75 to 170 grams per km and above will remain frozen for the 2026 to 2027 and 2027 to 2028 tax years.